Caltos

Loan Management System

SaaS

Fintech

Role: Lead Product Designer · 2025

Enabling businesses to run lending operations without heavy engineering or operational friction

View live product

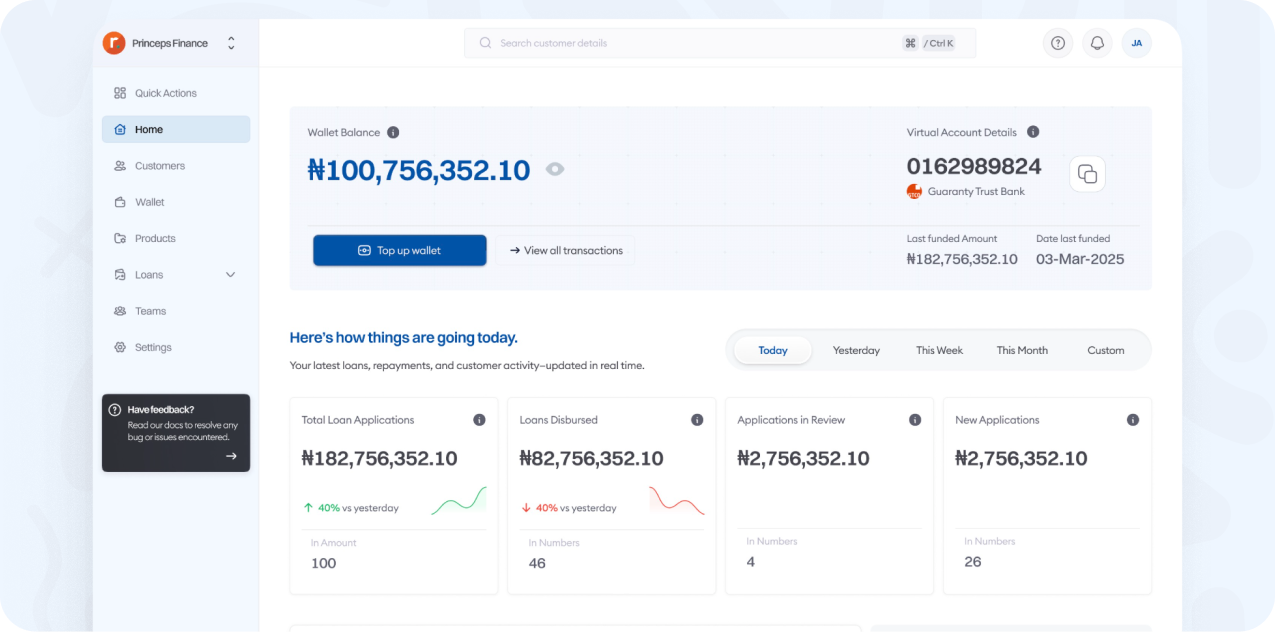

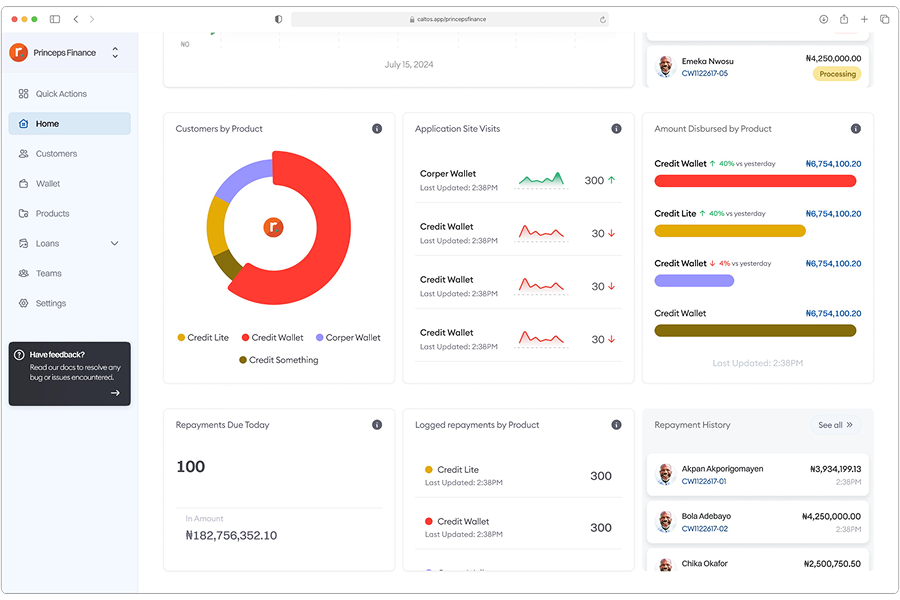

TL;DR

- Designed and led Caltos, a loan management system that allows business teams to configure and operate lending products independently.

- The platform has processed ₦7.3B+ across loan products created on it.

- Covers the full loan lifecycle: product setup, eligibility, disbursement, repayment, reconciliation, and reporting.

- Initially built for a narrow lending segment, then restructured to support multiple lending models, enabling adoption by additional lending companies.

Context

Most loan platforms are powerful but rigid. Launching or iterating on a loan product often requires long engineering cycles and forces businesses into predefined structures.

Caltos was built to give business and operations teams direct control over loan configuration and management, without introducing operational risk.

Insights That Shaped the Product

- Loan products were constrained by rigid, predefined buckets.

- Eligibility was surfaced only at rejection, leaving users without context or alternatives.

Rigid structures slow experimentation. Rejection-first eligibility breaks trust and kills recoverable demand. Both patterns needed to be redesigned.

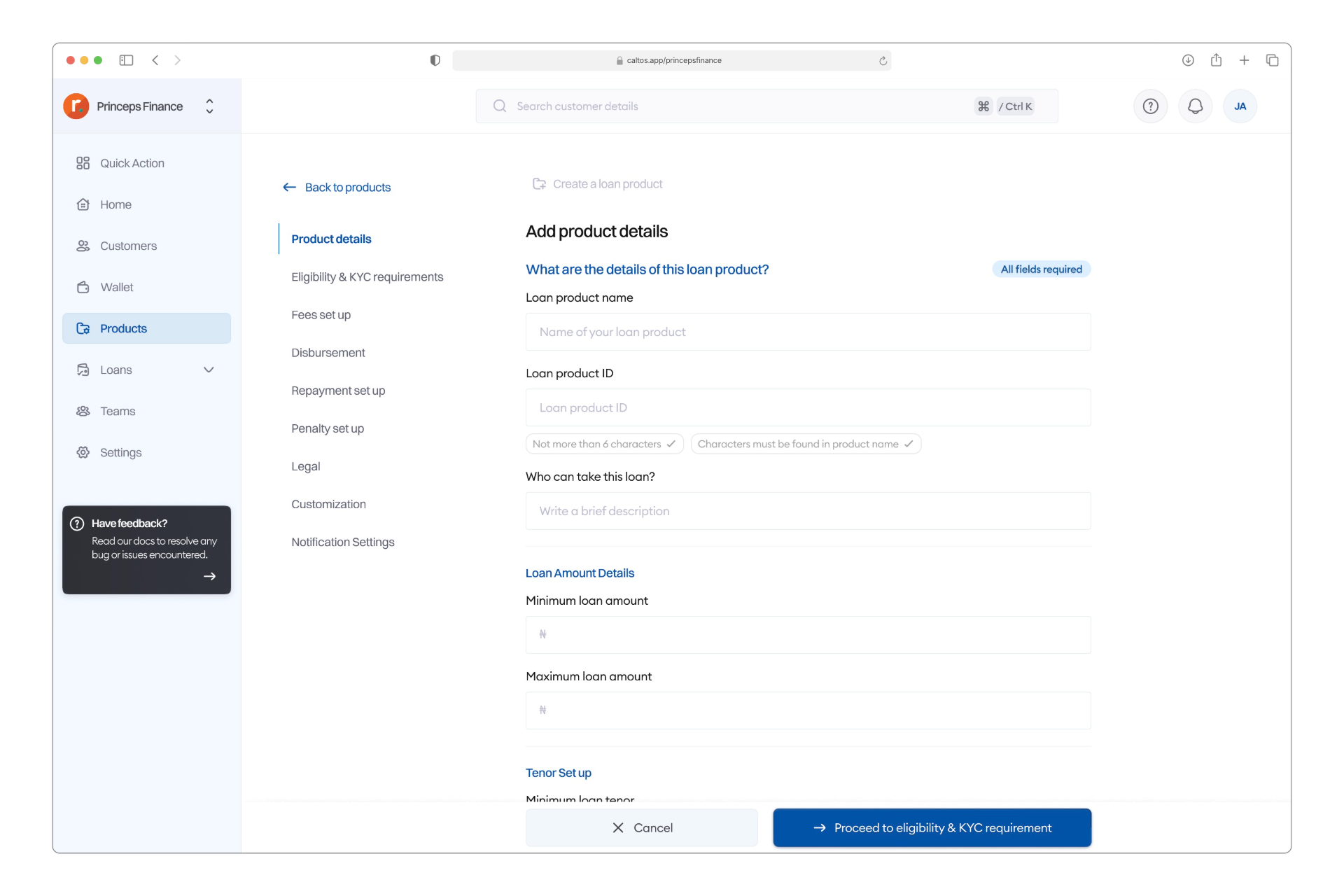

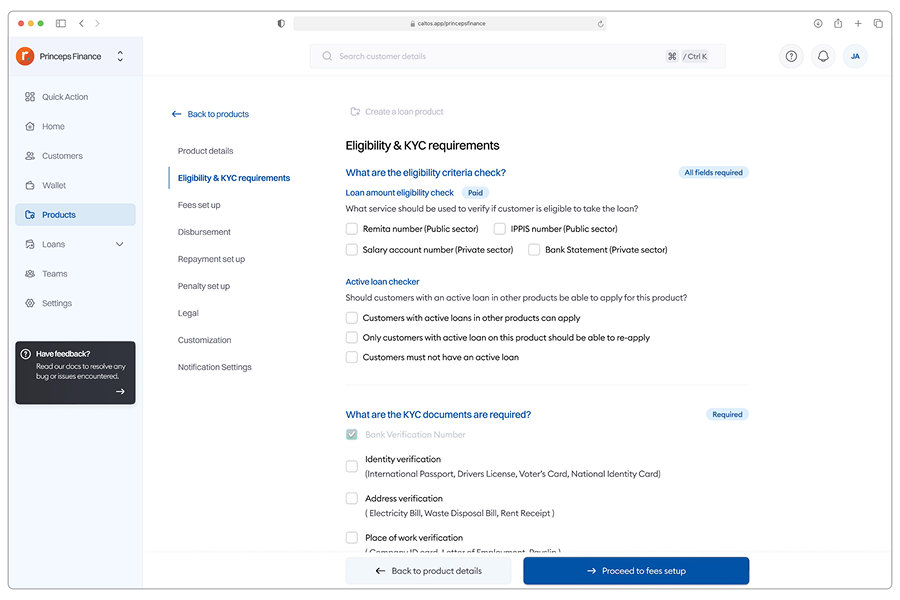

Loan Product Creation for Non-Technical Teams

A single dense configuration screen would have made errors inevitable.

A guided setup was necessary for non-technical teams configuring live loan products.

Loan creation was designed as a step-by-step flow that breaks complex configuration into clear, sequential decisions. This reduced setup errors, lowered cognitive load, and allowed teams to ship loan products without engineering support

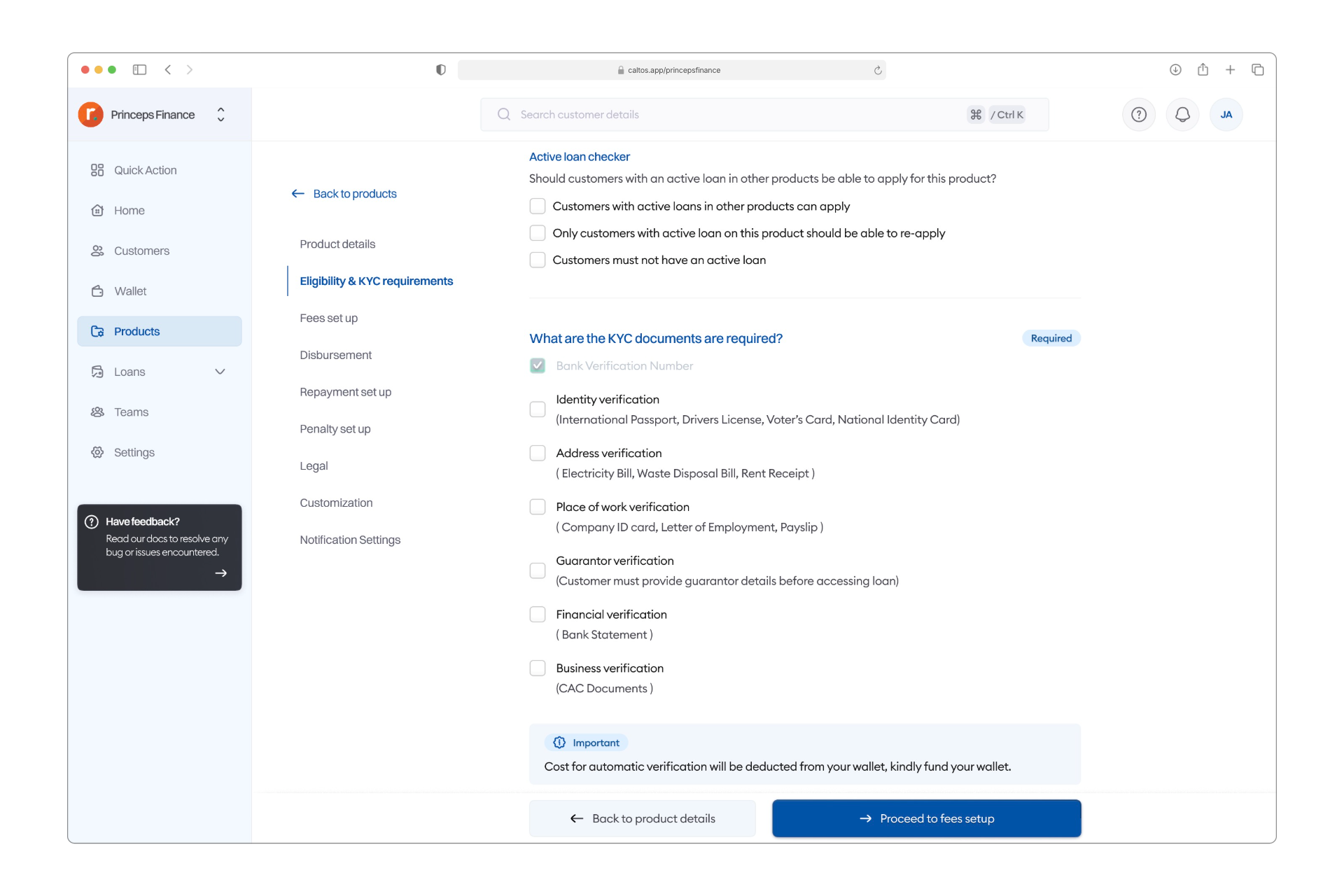

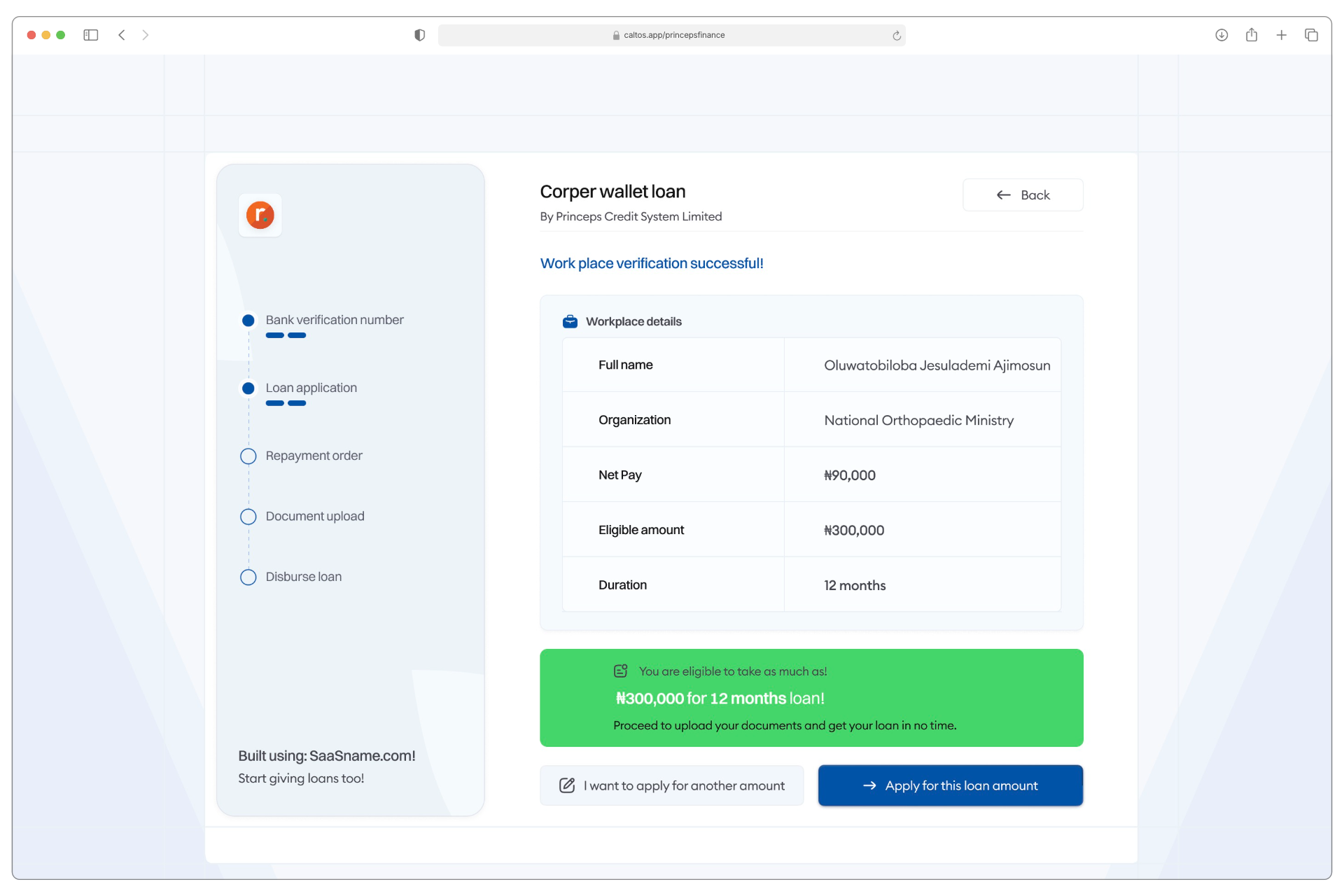

Eligibility as a Flexible System

Surfacing eligibility only at rejection breaks trust. Eligibility needed to be understood before commitment, not after failure.

Caltos treats eligibility as a flexible system rather than a fixed rule set, supporting different lending models (civil service, private sector, government workers). This allows users to understand their standing early and enables businesses to responsibly offer alternatives when appropriate.

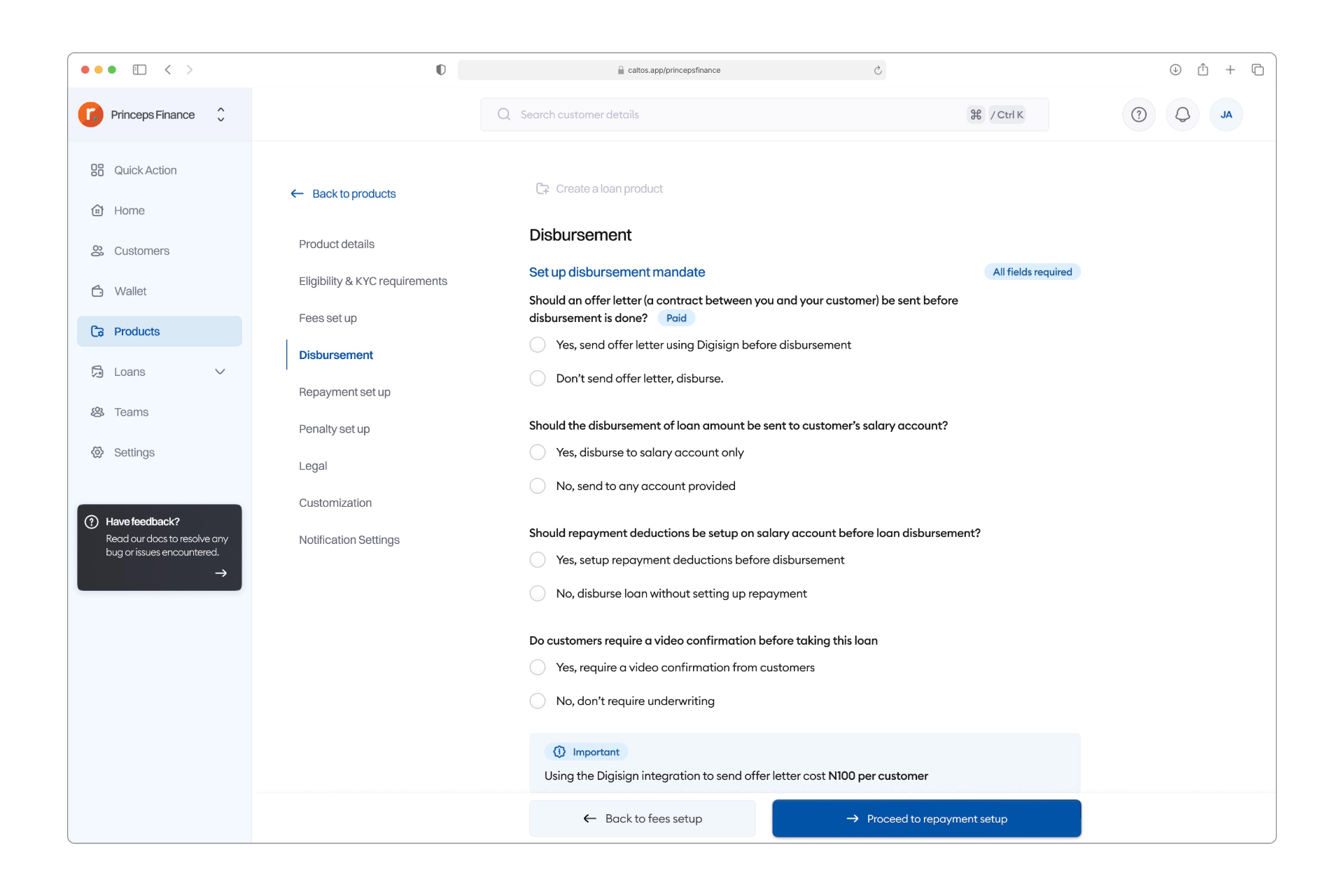

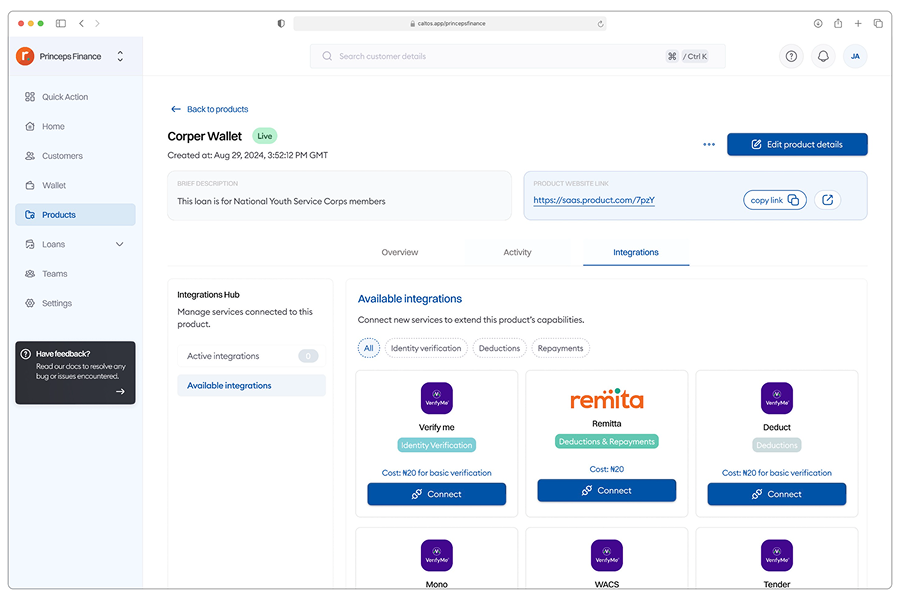

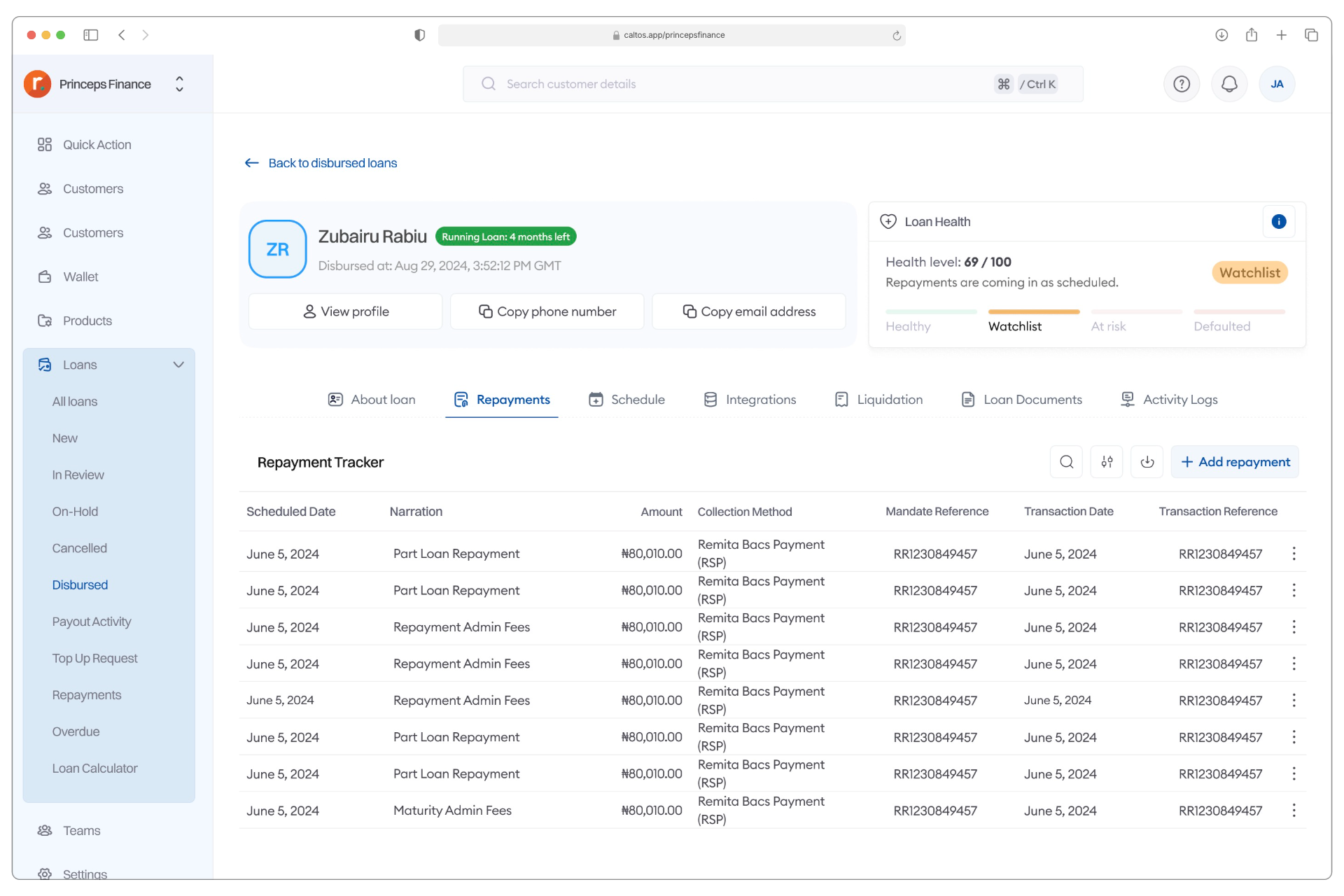

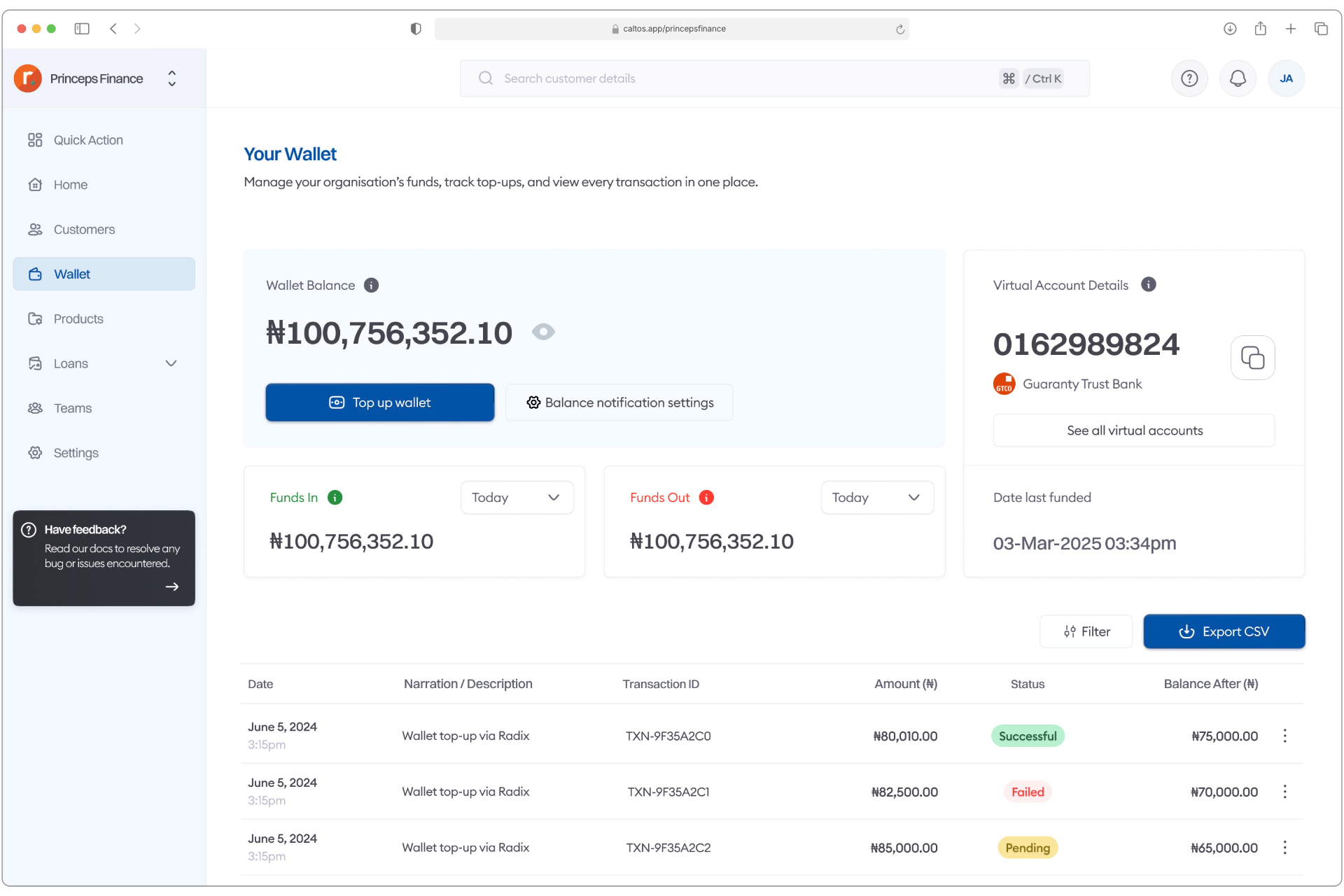

Designing for Repayment and Reconciliation

Loans do not end at disbursement. Any system that treats repayment as an afterthought creates operational debt.

Repayment structure and frequency are defined during product setup, preventing downstream bottlenecks. Integration with direct debit services improves collections and simplifies reconciliation across loan products.

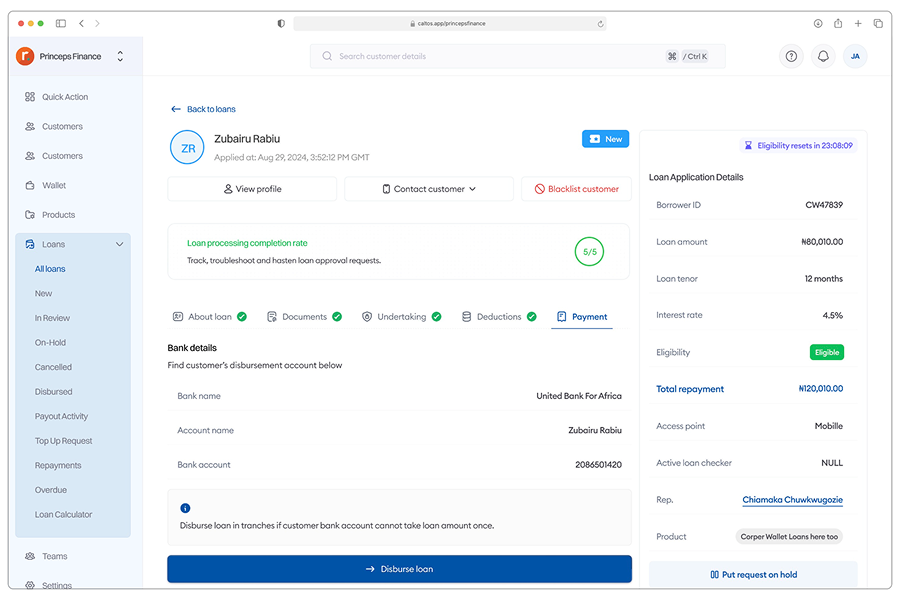

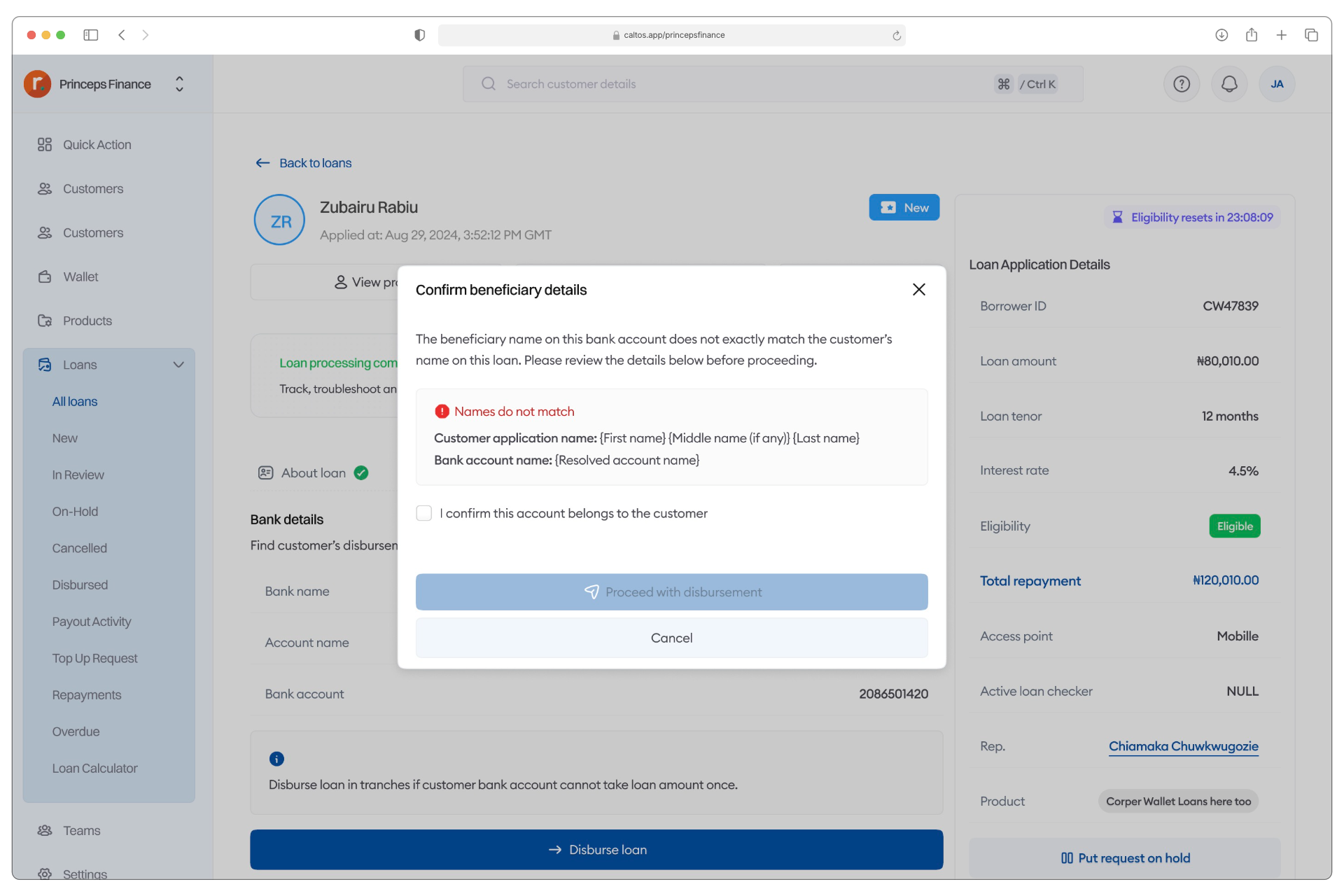

Fraud Risk and Guardrails

In lending systems, small shortcuts lead to large losses.

Caltos embeds guardrails directly into the flow:

- identity verification

- salary-account-aligned payouts

- repayment mandates before disbursement

- historical loan checks where applicable

These controls reduce risk while keeping operations predictable.

What Drove Adoption

Adoption was driven by:

- plain language instead of loan jargon

- guided decisions instead of dense forms

- clarity over compressed, one-screen workflows

The system remained powerful without becoming fragile.

Learnings

The first version of Caltos was too narrowly scoped. That constraint limited adoption.

Expanding the system to support broader lending models became the most important shift in the product’s growth. Designing for real-world behaviour — including misuse and misunderstanding — proved more critical than designing for ideal users.

Outcome

- ₦7.3B+ processed across loan products

- Loan product time-to-market reduced by months

- Multiple lending companies operating on the platform

- Reduced engineering dependency for lending operation